The Value of Very Early Prep Work for Retired Life in Singapore: Ensuring Financial Stability and Lifestyle in Your Golden Years

In Singapore, where the landscape of living costs proceeds to rise, the value of early retired life prep work can not be overstated. As individuals browse their jobs, the need for a robust monetary approach comes to be critical to guarantee not only security but also a high quality way of life throughout retirement.

The Monetary Landscape in Singapore

The monetary landscape in Singapore is identified by a robust economic climate, a high requirement of living, and a detailed social security system that jointly affect retirement planning. Singapore's economic climate boasts a strong GDP growth rate, driven by a varied commercial sector, including money, innovation, and manufacturing. This financial stability creates a favorable setting for people to build up wide range throughout their functioning lives.

Additionally, the high criterion of living in Singapore demands cautious monetary preparation for retired life. With a price of living that consists of high housing costs and health care expenditures, people must proactively address their financial demands to maintain their preferred way of living in retirement. The federal government has actually established a thorough social safety structure, mainly with the Central Provident Fund (CPF), which supplies people with a structured cost savings plan for retired life, home, and healthcare possession.

Nonetheless, dependence solely on CPF might not be enough for several individuals, as it may not totally cover all costs during retirement. more in depth. As a result, it is essential for Singaporeans to involve in positive retirement preparation, considering individual financial savings, financial investments, and various other monetary instruments to make certain a protected and meeting retired life

Benefits of Early Retired Life Preparation

Moreover, early preparation cultivates financial self-control, motivating people to create budgeting and conserving routines that can bring about an extra comfy lifestyle during retirement. With a well-structured plan in position, senior citizens can enjoy the freedom to pursue personal rate of interests, travel, or take part in pastimes without the stress and anxiety of economic instability.

In addition, very early retired life preparation can provide a barrier versus financial unpredictabilities and unanticipated expenditures, making certain an extra safe and secure economic placement. This insight can likewise minimize reliance on government assistance or family assistance, advertising freedom.

Eventually, the benefits of layoff preparation not just secure monetary stability but also boost general life satisfaction, empowering people to take advantage of their gold years.

Secret Techniques for Effective Prep Work

Just how can individuals efficiently prepare for a secure retired life in Singapore? The foundation of a robust retired life strategy lies in thorough economic literacy and aggressive budgeting. People must begin by assessing their existing monetary situation, consisting of cost savings, expenses, and financial debts, to determine areas for enhancement.

Establishing clear retirement objectives is necessary (more in depth). Individuals need to develop a target old age and desired way of living, which read the full info here will educate their savings strategy. Using a mix of interest-bearing accounts, investment options, and insurance items can assist expand one's portfolio, lessening threat and optimizing returns

Additionally, normal contributions to retirement financial savings, such as the Central Provident Fund (CPF), should be focused on. Automating these payments can enhance consistency and make certain that savings grow gradually.

In addition, people should constantly enlighten themselves on economic preparation and investment techniques. Engaging with monetary consultants can give personalized guidance tailored to one's distinct scenarios.

Last but not least, it is critical to occasionally assess and readjust retirement as personal and financial conditions change. more in depth. This aggressive technique not only guarantees financial security yet likewise fosters a lifestyle throughout one's gold years

Comprehending CPF and Retirement Schemes

Recognizing the Central Provident Fund (CPF) and different retirement systems is basic for efficient retired life preparation in Singapore. The CPF is a compulsory cost savings plan that sustains Singaporeans in their real this page estate, health care, and retired life requirements. Payments are made by both workers and companies, guaranteeing that people build up enough funds over their working life.

The CPF consists of several accounts, consisting of the Ordinary Account, Special Account, and Medisave Account, each offering distinct functions. The Ordinary Account permits housing and financial investment withdrawals, while the Special Account is assigned for retirement cost savings, supplying a higher rate of interest price. The Medisave Account is intended for medical care expenses, protecting economic stability in medical emergency situations.

Maintaining Quality of Life in Retired Life

Keeping a premium quality of life in retired life is vital for making sure that people can enjoy their golden years without financial stress. A well-structured economic strategy that includes cost savings, investments, and a thorough understanding of the Central Provident Fund (CPF) is click for more essential in attaining this objective. By examining expected living expenses and straightening them with retired life income resources, senior citizens can produce a sustainable spending plan that fits their lifestyle selections.

Additionally, prioritizing health and health plays a considerable role in boosting the lifestyle throughout retired life. Regular physical task, appropriate nutrition, and regular medical exams help prevent persistent diseases, ensuring that retirees can involve fully in recreation and social interactions.

Social interaction is just as crucial; growing partnerships and keeping an energetic social media can combat sensations of solitude and seclusion commonly experienced in retired life. Getting involved or volunteering in neighborhood tasks can also supply a feeling of purpose.

Inevitably, the mix of sound monetary preparation, health maintenance, and social involvement ensures that retired people not just fulfill their basic requirements however additionally enjoy satisfying and enriched lives in their retired life years.

Verdict

In conclusion, early preparation for retirement in Singapore is crucial for achieving financial stability and making sure a premium quality of life throughout the later years. By implementing effective techniques and comprehending the subtleties of the Central Provident Fund and various other retired life systems, people can grow a secure financial future. Furthermore, positive preparation promotes self-reliance and durability versus financial changes, eventually causing a satisfying retired life experience. Highlighting early action can substantially improve long-lasting economic health.

As individuals navigate their careers, the demand for a durable financial strategy comes to be vital to guarantee not only security however also a top quality way of life during retired life. With an expense of living that includes high real estate costs and healthcare costs, individuals have to proactively address their financial demands to preserve their wanted way of life in retirement.Recognizing the Central Provident Fund (CPF) and different retired life plans is basic for efficient retirement planning in Singapore.Maintaining a high top quality of life in retirement is critical for guaranteeing that individuals can enjoy their gold years without monetary stress. By carrying out effective approaches and understanding the subtleties of the Central Provident Fund and other retirement systems, individuals can grow a secure monetary future.

Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now! Susan Dey Then & Now!

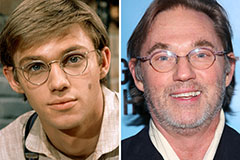

Susan Dey Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!